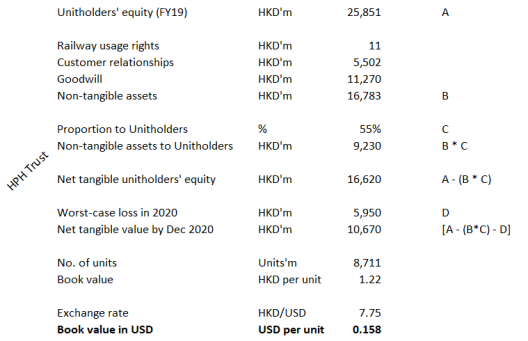

Make no mistake despite the headline, HPHT is still a strong BUY with our target of USD0.158 per unit or 46% above the current price of USD 0.108/unit. Now, we have added a catalyst to this target price – disposal of the ongoing management.

Management has failed to address many systemic issues that would have seen them ousted in companies with keen investor interest. There are enough external concerns on the minds of investors to warrant actions.

Concern #1: China passes security law, resulting in the US removing trading privileges with Hong Kong. Port volumes in Hong Kong would inevitably drop.

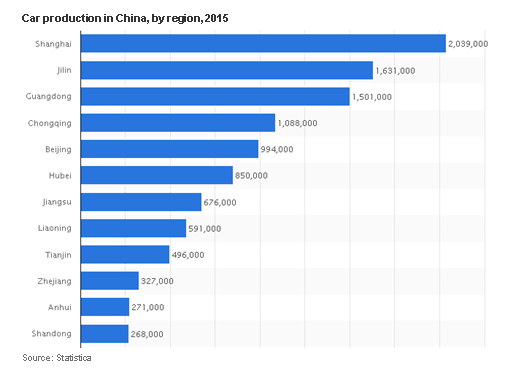

Bull says: There is a subtle distinction within port volumes. Gateway cargo volume refers to the cargoes that are destined for the hinterland. In contrast, Transhipment cargo volume relates to the cargoes that remain in the port waiting to board another vessel. The price-per-box of a gateway container is much higher than a transshipment container.

With the removal of trading privileges, the impact is felt mainly on Hong Kong’s transshipment volume. For each container that is to be imported from China, there will not be any tax and duty benefit to exporters to export their containers via Hong Kong. Hence, the transshipment volume in Hong Kong, consequently HPHT, would drop.

Against this backdrop, it is worthwhile to note that 1) it might not hurt as bad as the market expected as the transhipment volumes have skinny margins for the port, and 2) HPHT has about 56% stake in Shenzhen Yantian port located on the mainland. The port is competitive as a gateway hub with the capacity to expand. Removing of the trading privileges would hurt importers in the US, as the duties payable would increase or normalise as though the cargoes were exported directly from mainland China. It is also apt to point out that meddling with Chinese domestic affairs does not bring about any tangible benefit to the US citizens, at least from a trade perspective.

There will be retaliatory actions by the Chinese government. For sure, the immediate impact on trade volumes is not going to be pretty for HPHT and the wider maritime industry, which benefits from globalisation. The sentiment here should shift from expectation to mitigation. Are there credible measures management could take to mitigate the fall in transshipment volumes?

From an importer’s perspective, there needs to be logistical cost advantage of importing via Hong Kong vs importing directly via mainland China. HPHT could review the tariffs to be competitive against mainland China, offsetting the incremental import cost. Conceivably, there are many ways to evaluate the tariffs, either in port charges or marine charges or an improvement in port productivity to attract shipping lines to continue making regular calls.

The operational cost basis can be further rationalised to stabilise profits amid the loss of transshipment volumes. Based on its latest annual report, about 99% of the employees are full-time staff. With falling volumes, the employee-contract staff mix should be moderated to reflect a more temporal workforce.

Concern #2: Management and Directors continue to draw salaries and bonuses which are not in line with performance.

It is convenient for management to squarely lay the blame on trade tensions and coronavirus. Trade tension with the US has been around since Trump became the President of the United States (POTUS) in 2016. HPHT couldn’t possibly blame him throughout his term and perhaps the next 4-year term as well. Management needs to appreciate that they have to actively strategise to improve shareholders’ returns. The Board of Directors needs to safeguard shareholders’ interests. Suffice to say, the share price is a reflection of the incapability of management and the directors. Yet, at the same time, they draw salaries and bonuses that are incommensurable with the performance of the Trust.

Global trade screeched to a halt in March 2020. Since June 2020, major economies are gradually opening up to a new normal. Merchandise trade should resume flow. Is management capable of leading shareholders out of this crisis? For sure, if they continue to point the fingers to external factors, which they have done since IPO for the slump in the share price. Shareholders cannot be confident that they would implement structural changes to serve investors’ interests.

In this respect, based on the annual report filings, management continues to draw respectable salaries and bonuses for the dismal performance.

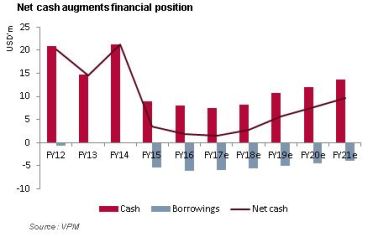

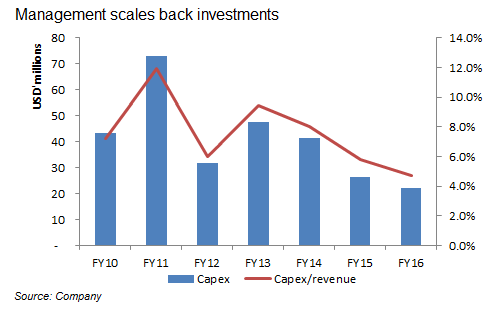

Concern #3: Debt level remains elevated. Would we ever see a manageable debt in HPHT’s portfolio?

No, management points fingers at external factors for scaling back its debt commitment. We thought it was a positive move by management to shed HPHT’s debt by HKD 1 billion annually. At least, there can be some reliefs in interest expense that crimps profit to unitholders. Year to June, it was disclosed that HPHT pared HKD 250 million. It is unlikely that management will keep to this commitment.

While we like the semi-annual distributions, it is apparent that the distributions are unsustainable. Instead of scaling back on distributions, which would have an immediate adverse share price reaction, we would have much preferred for HPHT to be a lean cash-rich trust without crushing debt burdens. Let us take a moment to remember Rickmers Maritime. HPHT could be a Rickmers Maritime if it prioritises share price performance over the core performance of its operations.

Understanding the risks of this counter

In all likelihood, HPHT could come to investors for more money to burn. How about unitholders back them up by supporting a potential rights issue? We would categorically slam this approach because Hong Kong is facing a structural decline in port volumes and that there are premium assets (land value) to be monetised. Think of SIA asking for more funds through rights and convertible bonds, instead of restructuring its assets. The share price tanked below the theoretical price, cum-rights. This is usually the case for companies begging for money to burn with no earnings-accretive plans or convincing strategy to stem systemic cash drains.

Complete acquisition or partial disposal? It could be that HPHT is left with just its legacy HQ assets in Hong Kong, with a sale of its mainland China operations to a Chinese port operator. The cash on sale would raise expectations of a bumper distribution to unitholders. Swapping Yantian Terminals (mainland Shenzhen) for Modern Terminals may happen, which would reduce the bumper harvest. We doubt the politburo would pass up a chance to exert commercial control over Hong Kong, especially in the port sector.

HKSA is detrimental to HPHT. Let us have a mini-throwback to the joint management scheme in 2017, whereby HPHT was confident of improving the profitability. It was apparent that was not the case. Despite narrowed cost base, the assignment of vessels to berths and the cargo mix to be handled are not favourable to HPHT. Consequently, HPHT profitability did not improve when it should have pulled a gap over the cost with a well-heeled revenue. The HKSA is no different in essence. Competition has eased now that the Kwai Tsing terminals in Hong Kong are under an operation team. As a bigger brother in Hong Kong compared to Modern Terminals, and certainly with a heavier invested asset, EBITDA should not be shared equally with Modern Terminals. It is of the case of a younger brother bullying the profits out of the older brother.

The critical risk is for management to continue leeching investors’ funds. Performance just does not match up with their remuneration, and that the Board of Directors is ineffective in expressing investors’ concerns.

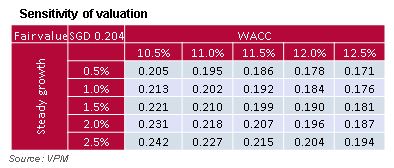

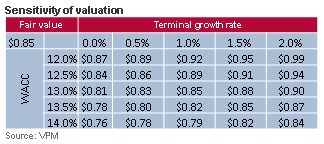

Trading opportunities backed by the valuation

Our stress-tested valuation of USD 0.158 per unit takes into account the HKD 0 revenue in 2020, complete impairment of intangible assets, and an acquisition by a Chinese port operator when the political sentiments moderate. The implementation of the Hong Kong Security Law saw HPHT touching a low of USD 0.089 per unit on 30 June 2020, before mysteriously closing at slightly above the previous day’s close price.

The bulk purchase happened between 5pm and 5:05pm on that very day, pointing towards a keen institutional interest in a bottom-low HPHT. On 1 July 2020, the 23rd anniversary of Hong Kong’s return to China, share price surged 11% when for the past 2 decades or so, this day was a day of protests crippling Hong Kong stock market. The hardline approach by Beijing is working to bring about stability in Hong Kong. There is light at the end of the tunnel. Dissidents may leave Hong Kong to the UK (we bet UK residents are fuming now that they didn’t leave the EU for more Hong Kongers).

Where would the share price go is anyone’s guess. But without the 1H earnings report card, the benefit of the doubt would be given to HPHT to perform. After all, our valuation is based on HKD 0 revenue for 2020 amid the coronavirus outbreak.

Disclaimer applies.

Source: Global Invacom

Source: Global Invacom